新加坡税务局(IRAS)发布《关联方贷款转让定价指引》(中英文对照)

来源:环球税务时报

编译整理:思迈特财税国际税收服务团队

The Inland Revenue Authority of Singapore (IRAS) has released transfer pricing guidance for related-party loans.For related-party loans not exceeding S$15m, taxpayerscan approximate an arm's length interest rate for the loan using the IRAS'published indicative margins. IRAS publishes the indicative margin at the beginning of each calendar year. The indicative margin is an alternative to performing a detailed transfer pricing analysis to determine arm's length interest rates and is not mandatory. Taxpayers choosing not to apply the indicative margin must apply an interest rate in line with the arm's length principle and prepare contemporaneous transfer pricing documentation if required.

近日,新加坡税务局(IRAS)发布了《关联方贷款转让定价指引》。对于不超过1500万新币的关联方贷款,纳税人可以使用IRAS公布的指导利率来估算贷款的独立交易利率。IRAS在每个公历年年初公布指导利率。指导利率是执行转让定价详细分析以确定独立交易利率的替代选择,并不是强制性的。纳税人选择不适用指导利率,必须适用符合独立交易原则的利率,并准备必要的转让定价同期资料。

Newly, for 2022 on wards, IRAS is issuing indicative margins only for base reference rates that are RFRs, such as the Singapore Over night Rate Average ("SORA"), the Secured Over night Financing Rate ("SOFR"), or the Sterling Over night Index Average("SONIA").

最新消息,从2022年起,IRAS只对RFRs的基准利率,如新加坡隔夜平均利率(“SORA”)、有担保隔夜融资利率(“SOFR”)或英镑隔夜平均指数(“SONIA”)发布指导利率。

Related party loans

关联方贷款

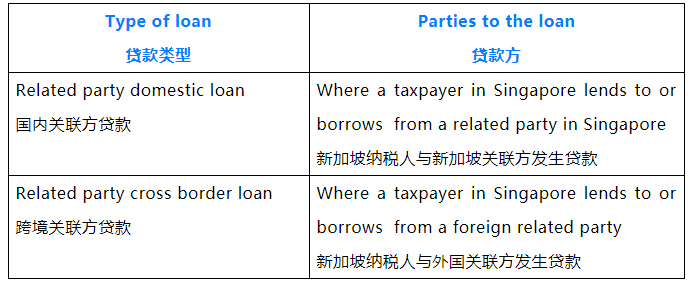

A related party loan arises when a taxpayer lends money to or borrows money from a related party. It can be:

关联方贷款是纳税人向关联方贷款或从关联方借款。它可以是:

Arm’s length principle for related party loans

独立交易原则在关联方贷款中的适用

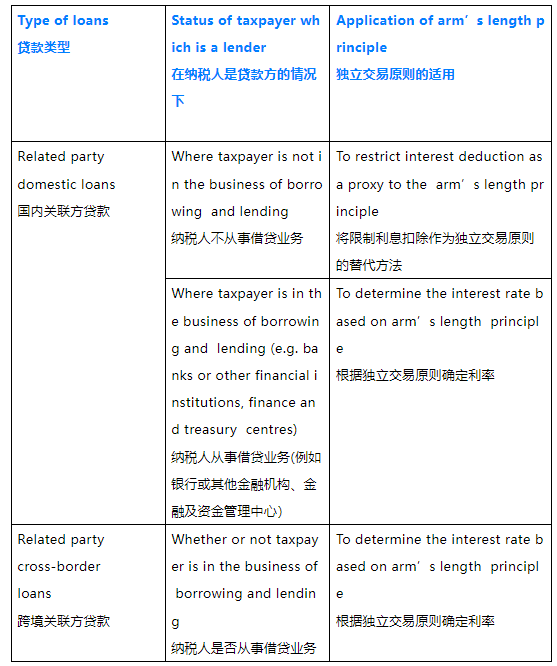

The arm’s length interest rate is the interest rate which would have been charged between independent parties under similar circumstance sat the time the indebtedness arose.The application of the arm’slength principle to related party loans is as follows:

“独立交易利率”是指独立当事方在发生类似债务的情况下,从中所收取的利率。“独立交易原则”在关联方贷款中的适用情况如下:

In the case of a related party domestic loan provided by a taxpayer which is not in the business of borrowing and lending,IRAS will generally apply interest restriction in place of the arm’s length methodology. This is done by limiting the taxpayer’s claim for any interest expense to theinterest charged on such loan.

若国内关联方贷款是由不从事借贷业务的纳税人提供的,IRAS一般会采用利息限制作为独立交易原则的替代方法,这种方法通过限制纳税人对贷款收取的利息费用的扣除实现。

Example:

举例:

● Taxpayer A provided aloan to Taxpayer B S$100,000;

纳税人A向纳税人B提供10万新币贷款;

● Interest charged byTaxpayer A in 2021 S$100;

纳税人A在2021年收取100新币利息;

●Interest expense incurred by Taxpayer A in providing the loan in 2021 S$1,000;

纳税人A在2021年提供贷款的过程中产生的利息费用为1000新币;

● Taxpayer A’s interest expense claim of S$1,000 is limited to S$100.

纳税人A对1,000新币的利息费用的扣除限额为100新币。

While the interest restriction does not exactly conform to the arm’s length principle, it nonetheless serves as a close proxy to the arm’s length principle. This is tofacilitate taxpayers’ efforts in complying with the arm’s length principle for related party domestic loans while keeping compliance cost low.

虽然利息限制不完全符合独立交易原则,但仍是一个独立交易原则的近似替代方法。这是为了使纳税人能够以低成本在国内关联方贷款中遵守独立交易原则。

In all other cases, taxpayers should adhere to the arm’s length methodology to determine the interest charges. In the event thattaxpayers fail to do so:

在其他情况下,纳税人应遵循独立交易原则的方法来确定利息费用。若非如此:

(a) IRAS will disregard any interest expense inexcess of the arm’s length amount determined by IRASfor tax deduction purpose. This is notwithstanding that tax may have been withheld on the full interest payment to the foreign related party.

(b) IRAS may not support the taxpayers in MAP discussions to resolve any double taxation arising from any transfer pricing adjustments made by IRAS orforeign tax authorities in relation to the interest charges.

(a) IRAS将拒绝给予任何超过其所厘定的符合独立交易原则数额的可扣除利息费用,尽管支付给外国关联方的全部利息在支付时可能已缴纳预提税。

(b) IRAS may not support the taxpayers in MAPdiscussions to resolve any double taxation arising from any transfer pricingadjustments made by IRAS or foreign tax authorities in relation to the interestcharges.

(b) IRAS可能不会支持纳税人在相互协商程序中解决因IRAS或外国税务机关就利息费用作出转让定价调整而引起的双重课税问题。

IRAS does not regard interest-free related party loans as arm’s length transactions, unless taxpayers have reliable evidence that independent parties under comparable circumstances would similarly provideloans without charging any interest.

IRAS不把关联方无息贷款视为独立交易,除非纳税人有可靠证据证明,在类似情况下,独立关联方会以类似方式提供贷款而不收取任何利息。

Indicative margins on related party loans

指导利率在关联方贷款中的应用

The indicative margin is not mandatory. Taxpayersmay adopt a margin that is different from the indicative margin provided thatthis is consistent with the guidance to determine the arm’s length interestrates.

指导利率不是强制性的。纳税人可采用不同于指导利率的利率,但其须与确定独立交易利率的指引相一致。

Taxpayers can choose to apply the indicative marginto each related party loan that does not exceed S$15 million at the time theloan is obtained or provided. The threshold is based on the loan committed andnot the loan utilised. For example, taxpayer obtained a loan facility of S$20million from a related party. Taxpayer cannot apply the indicative margin not with standing that the amount utilised or intended to be utilised is less than S$15 million.

纳税人可以选择在获得或提供贷款时,对每笔不超过1500万新币的关联方贷款适用指导利率。这个门槛是基于承诺的贷款而不是使用的贷款。例如,纳税人从关联方获得2000万新币的贷款,即使已动用或拟动用的金额低于1500万新币,纳税人也不能适用指导利率。

The indicative margin is applicable to both Singapore-dollar denominated and foreign currency denominated related partyloans. For related party loans denominated in foreign currencies, the threshold(in Singapore dollars) is to be determined based on the prevailing exchange rate at the time the loans are obtained or provided.

指导利率适用于新币及外币计价的关联方贷款。对于以外币计价的关联方贷款,将根据获得或提供贷款时的现行汇率确定新币门槛。

Example:

举例:

● Taxpayer provided a loan (i.e. Loan A) to arelated party;

纳税人向关联方提供贷款(如贷款A);

● Loan committed under Loan A is US$14 million;

A项下承诺的贷款为1400万美元;

●Suppose the exchange rate at the time Loan A is provided is US$1: S$1.42;

假设提供贷款A时的汇率为1美元:1.42新币;

● S$ equivalent of Loan A is S$19.88 million;

相当于贷款A为新币1988万;

●Taxpayer cannot apply the indicative margin for Loan A as it exceeds the threshold of S$15 million.

纳税人不能申请A贷款适用指导利率,因为它超过了1500万新币的门槛。

Taxpayers would decidethe appropriate base reference rate onwhich to apply the indicative margin.

纳税人可以决定适用指导利率加适当的基准参考利率。

Example:

举例:

● Taxpayer provided afloating rate loan of S$10 million to its related party on 1 January 2021;

纳税人于2021年1月1日向关联方提供1000万新币的浮动利率贷款;

● Taxpayer used SIBOR as the base reference rate for the related party loan;

纳税人使用SIBOR作为关联方贷款的基准参考利率;

● Taxpayer chose to apply the indicative margin;

纳税人选择适用指导利率;

●Suppose the indicative margin is 2.50%;

假设指导利率为2.50%;

●The interest rate for the related party loan would be 2.50% plus the appropriate SIBOR rate.

关联方贷款的利率为2.50%加上适当的SIBOR利率。

For fixed rate related party loans, taxpayers can apply an appropriate swap rate as the base reference rate. For fixed rate related party loans denominated in Singapore dollars, besides an appropriate Singapore dollar swap rate, taxpayers can consider applying an appropriate Singapore Government Securities (“SGS”) yield36 as the base reference rate.For floating rate loans, some examples of base reference rates include the SIBOR and LIBOR.

对于固定利率的关联方贷款,纳税人可适用适当的掉期利率作为基准参考利率。对于以新币计价的固定利率的关联方贷款,除适当的新币掉期利率外,纳税人可考虑适用新加坡政府证券(SGS)利率作为其基准参考利率。对于浮动利率贷款,基准参考利率包括SIBOR和LIBOR。

TP documentation

转让定价文档

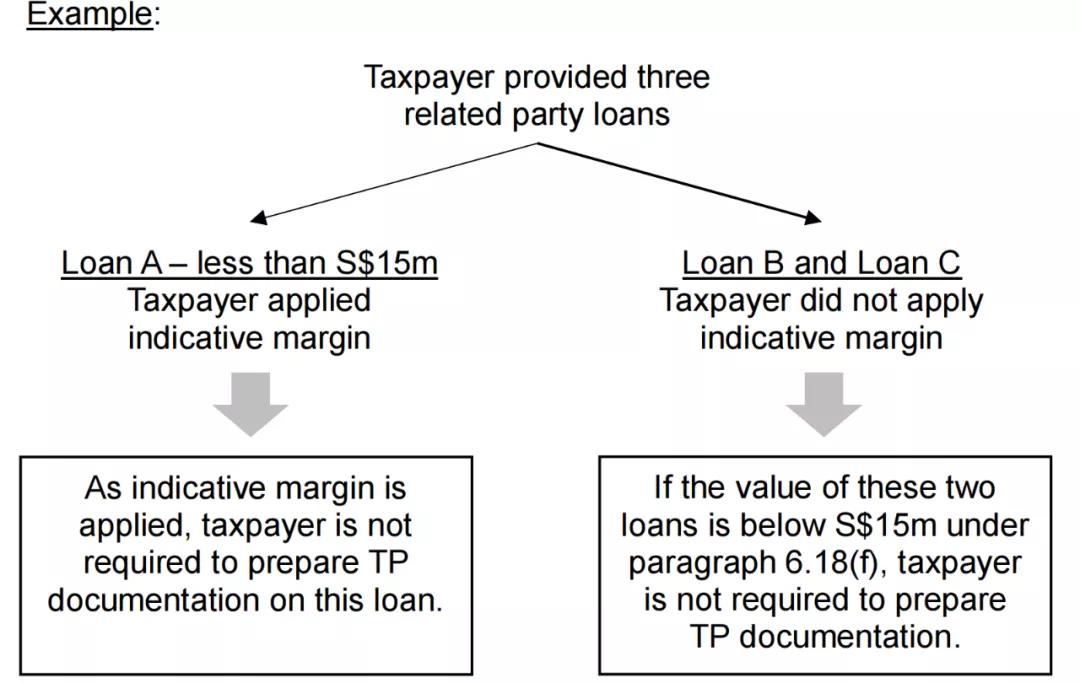

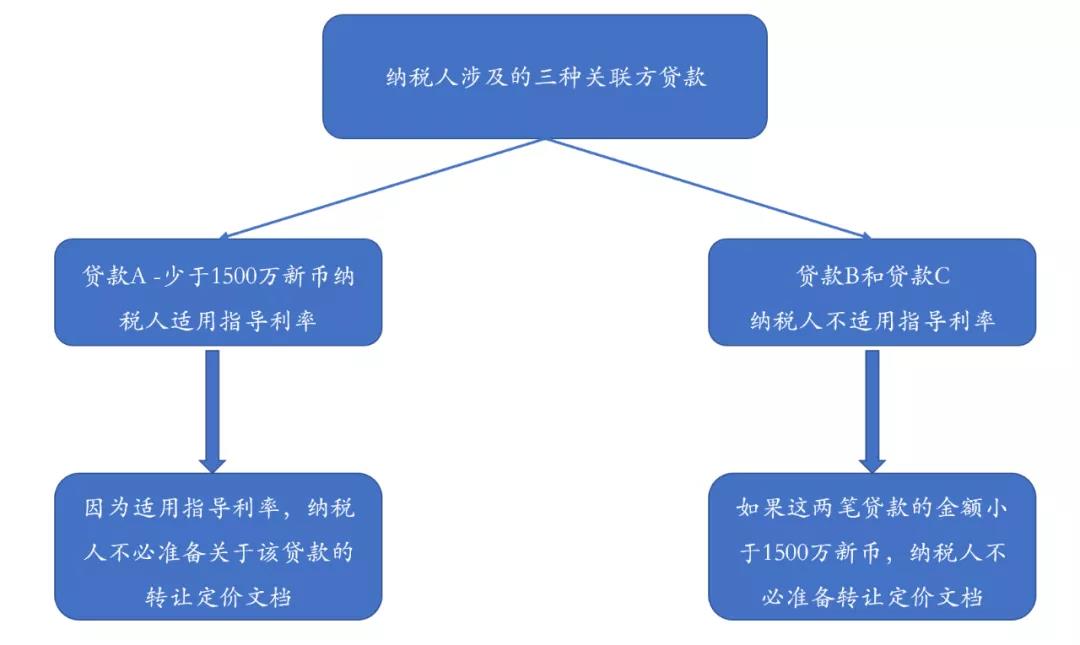

If taxpayers choose to apply the indicative margin for their related party loans, they are not required to prepare TP documentation for such loans. Such loans will also be excluded from the loan threshold of S$15 million.

如果纳税人选择关联方贷款适用指导利率,则无需为此类贷款准备转让定价文档,该贷款也将被排除在指引所规定的1500万新币的贷款门槛之外。

Conclusion

结论

If the lender and borrower of a related party loanare both Singapore taxpayers, IRAS will limit the interest expense claimed bythe lender on the loan. If the related party loan is a cross-border loan, taxpayersshould ensure compliance with the arm's length principle. The indicative marginis an alternative to performing a detailed transfer pricing analysis to determine armʼs length interest rates and is not mandatory.

如关联方贷款的贷款人和借款人均为新加坡纳税人,IRAS会限制贷款人的利息费用扣除。如果关联方贷款是跨境贷款,纳税人应确保遵守独立交易原则。指导利率是执行转让定价详细分析以确定独立交易利率的替代选择,并不是强制性的。